DUROPLY POSTS A ROBUST 58.43% GROWTH IN SALES DURING THE FY23, TO Rs. 302.34 CRORES FROM Rs. 190.83 CRORES REPORTED DURING FY22

DUROPLY REPORTS Rs. 5.23 CRORE PAT IN FY23, AS COMPARED TO Rs. 6.31 CRORE LOSS REPORTED DURING FY22

SALES INCREASED TO Rs. 84.22 CRORE DURING Q4 FY23 FROM Rs. 54.63 CRORE DURING THE SAME QUARTER LAST FISCAL, GROWING BY 54.15 %

DUROPLY’S CONTINUED IMPROVED PERFORMANCE DURING FY23 REFLECTS PRODUCT INNOVATION AND AGGRESSIVE SALES

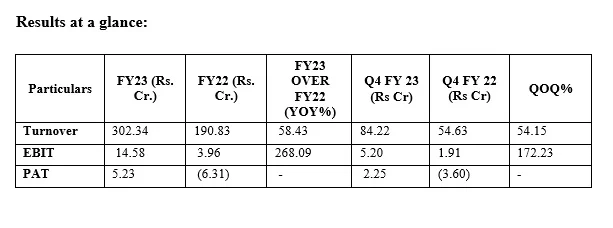

Duroply Industries Limited, India’s premium and most experienced plywood manufacturer amongst the leading players, has reported a robust 58.43% growth in sales during the financial year 2022 – 23, to Rs. 302.34 crores from Rs. 190.83 crores reported during last fiscal. The Company has maintained its profitable journey during the financial year 2022 – 23 and has reported profit after tax of Rs. 5.23 crore during the year. Earnings before Interest and Tax (EBIT) during the FY23 increased by 268.09%, to Rs. 14.58 crore from Rs. 3.96 crore reported during last fiscal.

The Company has done sales of Rs. 84.22 crore during Q4 FY23, a rise of 54.15% over the same quarter last fiscal year sales of Rs 54.63 crore. Profit after Tax for the Company stood at Rs. 2.25 crore during Q4 FY23, as compared to a loss of Rs 3.60 crore recorded by the Company during the same quarter last financial year. Earnings before Interest and Tax (EBIT) during Q4 FY23 increased by 172.23%, to Rs. 5.20 crore from Rs. 1.91 crore during same quarter last fiscal.

Commenting on the results, Mr. Akhilesh Chitlangia, Executive Director and Chief Operating Officer, Duroply, said, “Our performance across FY 23, and especially in Q4 gives us immense confidence that we are on the right path. Following the infusion of funds by way of preferential issue of fresh equity and warrants, this year, we invested heavily in our brand with four times increase in spend amounting to 4.1% of sales. The capital infusion has also allowed for significant improvement in operating parameters resulting in overall volume increase, better capital management, and unlocking our supply chain. Benefits of the same are visible in the revenue growth and return to significant profit margins over the year.

I take this opportunity to thank all our stakeholders, customers, suppliers and investors, for the turnaround we have achieved especially keeping in mind the hardship the company faced during the Covid induced disruption. We are confident that this turnaround is sustainable and will propel the company into the next orbit.

Our focus for FY 24 is to further improve our supply chain management, further invest in our brand, grow our footprint across the country along with our unwavering commitment towards quality. We intend to play a significant part in the interior infrastructure needs of India, ensuring that high quality Plywood is available to our growing nation.”